Ahh, trust accounting. So simple, yet so complicated. Like a spider’s web - or a bee hive. And by that I mean you have to be careful. Trust accounting is full of bitey little insects that will make your life miserable if given the opportunity. Our previous trust funds request workflow (or lack of) was one particularly annoying insect - and we’re happy to say we’ve squashed it. Rex (alongside all the other trust software we’ve reviewed) was missing a solid workflow for getting funds into trust. A lot of agencies deal with prepaid VPA, and often find themselves in a situation where funding must be requested and received before advertising can be booked. If that sounds like you, you’ve probably been doing one of the following:

- Sending a quick email or phoning the client advise them to pay a certain amount into your trust account. This makes it hard to give sufficient detail on what you plan on spending the money on - especially when pre-planned marketing packages are involved. This means there’s no clear record on whether or not funds have been requested, nor which are outstanding.

- Sending a VPA schedule with the amount you’d like the client to pay on it. Again, this can make it hard to keep track of what you’ve requested and what the client has paid.

- Issuing a VPA invoice, then transferring funds from your general account into trust when receipted - and then paying back out to the general account (or suppliers) once you’ve actually spent the money. Just looking at that mouthful, you can imagine this is hardly ideal. Not only does this force your administration or accounting staff to waste years of their lives shuffling money around like some Thimblerig street magician, but there’s the added issues with timing and accounts and tax and so on and so forth.

- Some convoluted combination of some or all of the above.

The thing is, trust requests aren’t like normal invoices. In fact, they’re very, very different. Trust only has two modes of transaction: ‘money in’, and ‘money out’. There’s no profit, no tax - it’s the digital equivalent of leaving some money in your neighbour’s piggybank for the weekend.And therein lies the problem. Requesting trust funds to be paid via invoice incurs those nasty little ‘+GST’ brackets that don’t belong (as no service has yet been rendered) - and money needs to be shifted back and forth from your general account to your trust account like a pea under one of the three cups of some shifty con artist on the streets of New York. It was clear something had to be done. We needed a solid, easy way to request trust payments. So we developed a new workflow, a new kind of ‘non-invoice’ (a friendly, physical reminder of money you’ve requested to be paid into your trust account by your clients), and for speed, simplicity and better oversight, we synced it all up with Rex’s VPA functionality. Now, Rex’s trust funds requests system allows you to:

- Create professional-looking trust funds requests for clients with clearly itemised VPA or other products (and automatically direct clients to pay them into the right bank account).

- Easily identify which VPA items you’ve requested for money for.

- Request other money into trust (e.g. sales deposits) using the same simple workflow as you would for VPA items.

- Efficiently follow up trust fund requests with confidence using our new system lists and reports.

- Raise invoices and pay them out of trust immediately as they actually fall due, saving you time on your normal invoice-chasing workflows, and making them much clearer.

- If your agency runs multiple trust or interest bearing deposit accounts, it’s easier than ever to point clients to the appropriate one to deposit payables into - which in turn, thanks to a little code magic, also makes accurate tracking a breeze.

A simpler way to request VPA pre-payments

So how does the new functionality work? Let’s break it down into a few basic steps.

- Step 1: Meet with the owner to discuss the campaign, (as per usual).

- Step 2: Once you‘ve decided on a VPA campaign, construct it in Rex, (as per usual).

- Step 3: (Here comes the fun part). Create and send a trust funds request to the owner. Follow them up if late and record payments against the relevant requests as the money comes in.

- Step 4: Now that you have all the funds, issue invoices and apply payments from trust as payables fall due for particular VPA items.

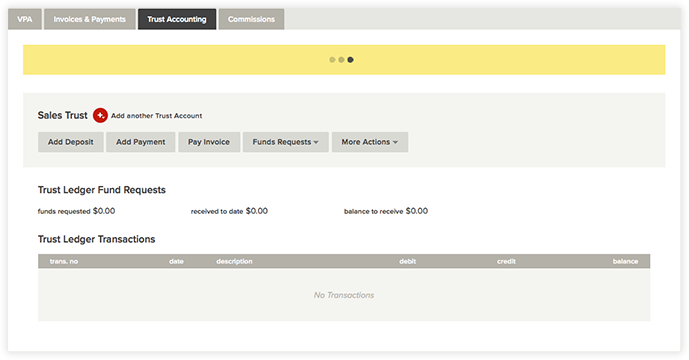

And that’s it - you’re done. But don’t take my word for it. Let’s take a closer look. (For brevity's sake, we’ll start from Step 3). Heading to the Trust accounting tab on a listing record, you’ll notice a new section: Trust Ledger fund requests.

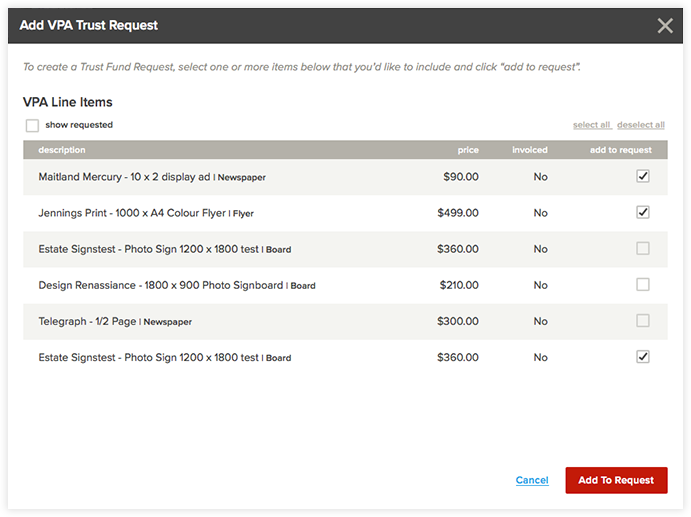

Pretty self-explanatory, really; you can request trust funds like VPA or other custom payments.So now we know the lay of the land, let’s add a new trust request. Click Funds Requests and choose the appropriate option. Since we’ve linked up the VPA and trust functionality, any items you’ve previously added to your advertising schedule (from the VPA tab) will be listed here. Select the one’s you want to request funds for, and you’re away.

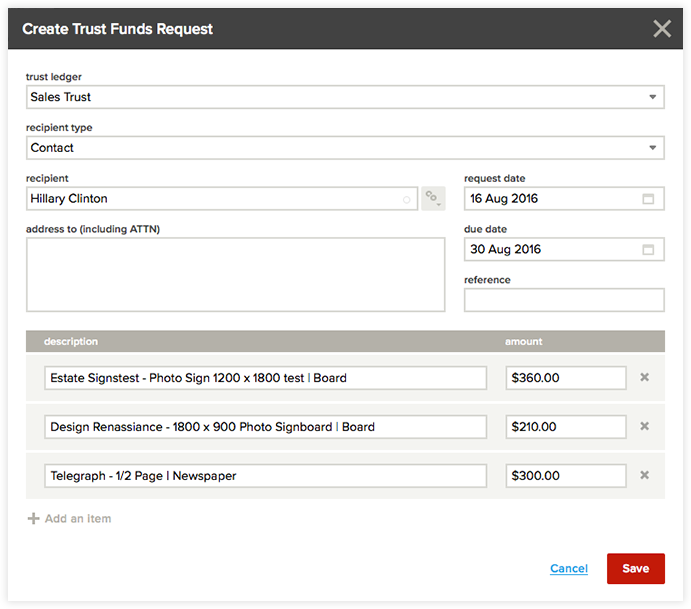

Once you’re happy you’ve ticked off everything you need, you’ll need to fill out this form:

More often than not, you’ll probably just need to add the client (or whoever is paying) as the recipient and save. Done and dusted. Now the request will appear in the Funds Requests list, and Rex will mark off all the appropriate VPA items off as requested and awaiting payment.Some agencies however, who run multiple trust accounts or investment banking accounts, will be happy to know we’ve designed this functionality with multiple ledgers in mind. If you need to, you can absolutely change which ledger this funds request should be paid into via the Trust Ledger field. You’ll also notice a new column in the VPA tab: Funds Requested. A simple feature, sure – but one that’ll come very much in handy when keeping track of what has and hasn’t yet been requested. It’s also worth noting that requests are flexible. Once they’ve been created, they’re not set in stone. They can be cancelled, and items can be added/removed even after you’ve clicked save (though this isn’t recommended once the paperwork has been sent to a client) - so you won’t need to worry too much about any changes to the VPA schedule should a client change their mind. And speaking of paperwork…

Fancier funds requests

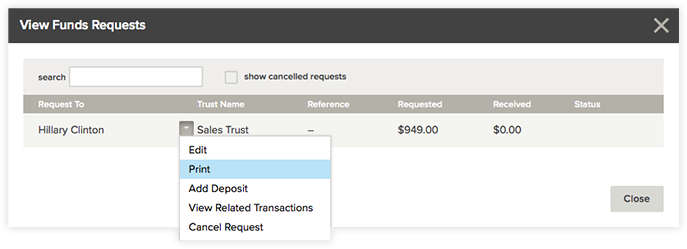

Once you’ve created your request and everything has been finalised, it’s time to go ahead and actually send it to the client. Once upon a time, this was a bit of a hassle. Not any more.Simply click View funds requests, select the right request and hit Print.

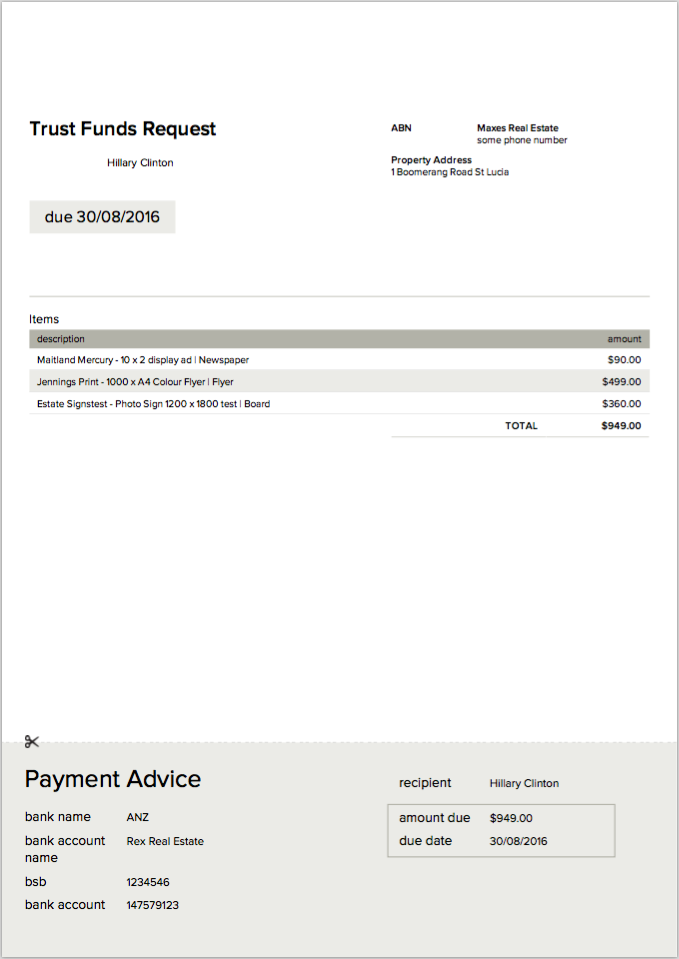

Client facing documents should always be as professional-looking as possible, and we’re pretty positive you’re going to love what our design team have come up with. It’s easy to print one of these for the client (or, if you prefer, download it as a CSV, HTML or PDF file to send electronically).

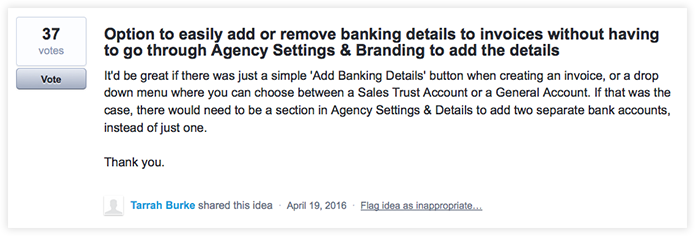

Hot-damn that’s a fine looking bit o’ paperwork, right there. It’s easy for clients to see exactly what they’re paying for, and exactly where payments go (you’ll notice the banking details are not for your general banking account which would normally be populated in a regular, garden-variety invoice). This means we’ve stamped out issues like this:

Thanks for the suggestion, Tarrah!

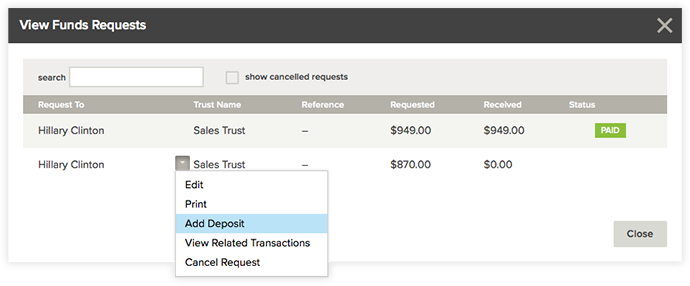

Adding deposits

Now for the home run.Once a client makes their deposit, you can apply it directly against the appropriate trust funds request straight from the ‘View trust funds requests’ dialog. You won’t need to waste time moving payments back and forth between accounts, and it’s far easier to keep track of where and why money is coming in, and which items have and haven’t been paid for.

Since Rex already knows exactly which request you’re applying the payment to, it can pre-populate certain fields and automatically update you with any remaining balance.

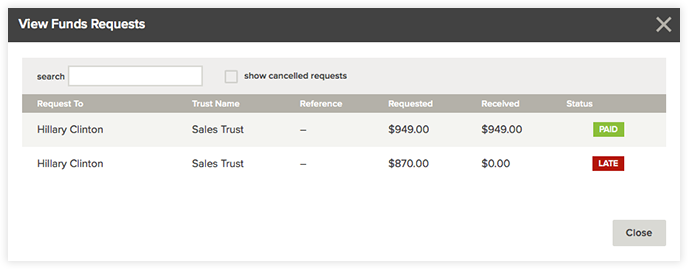

Keeping track of payments

Your trust funds request status is always visible. Paid requests are marked ‘Paid’ in a soothing green. Due and late payments, on the other hand, are marked as ‘Late’ in a stern red which helps pull any tardy clients out from hiding. Color coding makes everything better; it’s easier than ever to stay on top of your payments.

And that’s it. Simple, right? We think you’ll agree the new system is a pretty significant improvement on the way things were.